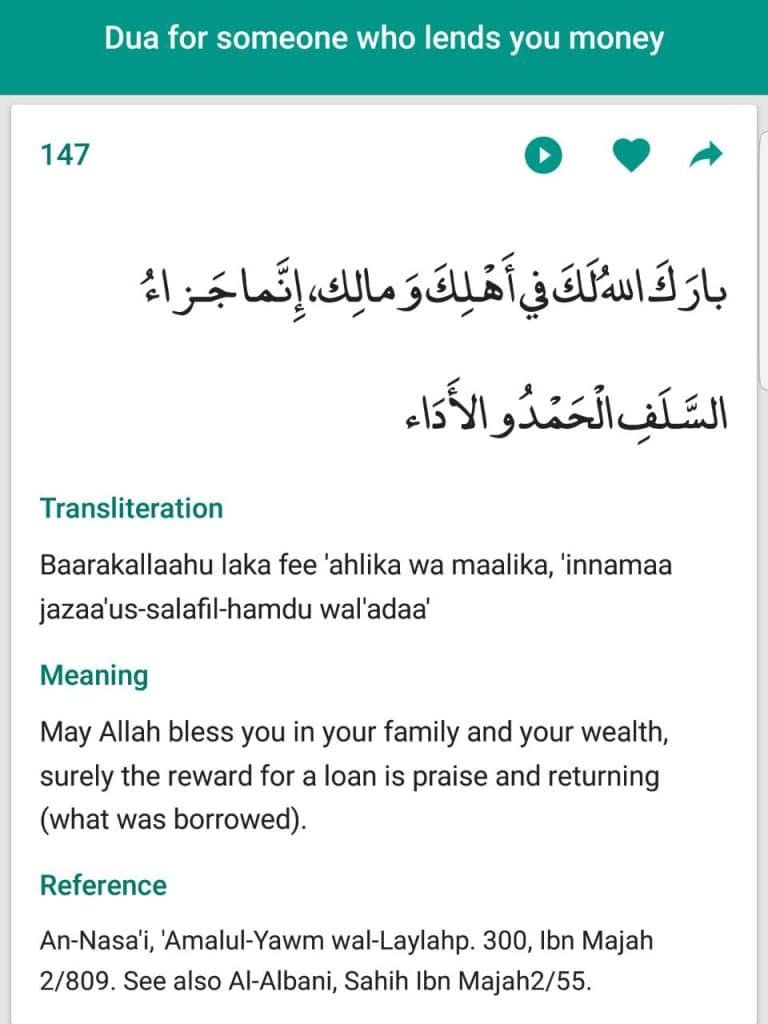

Dua For someone who lends you money In Arabic – 1

بارَكَ اللهُ لَكَ في أَهْلِكَ وَمالِك، إِنَّما جَـزاءُ السَّلَفِ الْحَمْدُ والأَدَاء

Dua For someone who lends you money In English transcription – 1

Baarakallaahu laka fee ‘ahlika wa maalika, ‘innamaa jazaa’us-salafil-hamdu wal’adaa’

Dua For someone who lends you money In English – 1

May Allah bless you in your family and your wealth, surely the reward for a loan is praise and returning (what was borrowed).

Ibn Majah: 2424

A guide to borrow money from friends and family

ASKING TO BORROW MONEY to a family member or friend can be a difficult and delicate conversation. The reality is that no one likes to be asked to part with their money. And when you agree to borrow money from a friend or family member, you risk creating tension in your relationship if expectations are not met, if your repayment plan is vague or if you do not pay on time.

But as difficult as asking for money from a parent or friend, it can be even more difficult to repay, depending on your financial situation. Therefore, if you are asking for money – or planning to lend money – you will want to follow these guidelines.

Do: Remember to cut yourself as an intermediary. Generally, when you borrow money from someone, you use that money to pay a business or an individual. If not, you should consider asking the person who is lending you money to repay directly the company or person you need, advises Julie Gurner, executive coach and doctor in clinical psychology.

It’s a good choice, especially if you’re thinking of lending money and you’re worried that the person you’re going to help with is not going to repay anyone or what they’re getting on time. “Offer to make the payment directly,” suggests Gurner. “For example, if they need it to pay their mortgage or rent, you will pay this bill directly, so that nothing comes to the parent or a friend.

” And if you want to borrow money from a loved one or friend, suggest the lender pay directly to your mortgage company or public service. In this way, you will eliminate a step by ensuring that the person or business you need to receive receives a payment directly from the source.

Don’ts: assume that applying for a loan will not affect your relationship. Elaine Rose, Public Relations Manager, moved from New York to Los Angeles in November 2017. She spent six weeks on short-term rentals while searching for housing.

“After receiving a large part of my” relocation “budget from Airbnb and Uber, I finally found the perfect place, but my first month of deposit and my deposit was missing, so I borrowed money from a 10 year old friend, “says Rose. “I always repay the loan and it will be done in October of this year, but I can say that even though we are still friends, it has put our friendship to the test,

Then she says. “Even though I have never missed monthly payments, the energy between us has changed and has become more distant.” If she could do it again, Rose would not be as sure she would borrow money from friends. “It really was a life lesson,” she says.

Do not forget to be attentive on social media platforms. “Lending money to a friend or family member can ruin a relationship, especially in the age of social media, where we share everything we do online,” said Andrew Selepak, professor of social media.

Telecommunications at the University of Florida, specializing in social media. “Knowing a friend or family member owes you money and seeing them post photos or videos having dinner or going on vacation when they have not returned the money can put you in anger and even become bitter, “he adds.

Do not borrow or lend more than you want. Before applying for or offering a loan, think carefully about your financial situation. If you know you’re going to have trouble paying back your friend or family member, is borrowing from a friend or family member the best strategy? Do you really know the finances of your friend or family member?

Maybe your friend or family member is doing just fine, and you’re asking for some money that would have been spent on vacation or retirement savings. You will want to think about this, otherwise you could exchange your short-term financial difficulties against a long-term constraint on your relationship.

And if you’re thinking of lending money to a friend or family member, “make sure it’s not more than what you’re ready to never see again,” he said. Selepak. He suggests that you consider the loan a gift, even if it is really a loan. In this way, “you will be less concerned about how they use it and when they will pay you back,” said Selepak. [See: 15 little things that impact your finances.]

Do: Talk to an accountant if you lend or borrow a lot. Things can get tough if you start borrowing or borrowing a lot of money. For example, if you give someone over $ 15,000 a year, you will have to file a tax return. But if you receive the same amount, you generally do not have to declare the donation on your taxes, even if the financial situation of each is different and it is better to consult a tax planner.

And do not forget that if you lend money to someone and repay you interest, you have to declare it. Do not: co-sign for a loan. Yes, you can co-sign a loan to help a family member or friend access money, but experts usually say it’s not a good idea. If a family member or friend can not repay the loan on time, you will be required to take the blame and if you can not repay the loan, your credit score could collapse.

To do: prepare a repayment plan and agree on important details. Lending money should not be a bad experience, insists Bill McCue, founder and executive consultant for McCuenications PR in New York. “I have lent money to friends over the years, and just recently, a few months ago, when a close friend needed money to buy a guitar.

a drama-free experience for the holidays is to agree deadlines or deadlines, [and] if the person asks to repay the loan in installments, “McCue said. It is a good idea to put your contact information in writing so that the expectations of both parties are clear. And it can not hurt the development of an emergency plan, in case something goes wrong.

For example, if you borrow money and you plan to repay the person after receiving the expected bonus, you can set a payment plan in case this unexpected windfall does not materialize.

If you are unable to repay the loan, explain your situation to the person who loaned you the money, McCue adds. Chances are, your friend or family member will not be angry, but they will probably be angry if you disappear on them and avoid creating a concrete repayment strategy.

On the other hand, if you are lending money to someone and you really need it, you should mention it as well, rather than harboring resentment. “Open and outgoing communications are essential,” McCue said. In fact, if you talk to your friend or family member about a late payment and you end up repaying it in a reasonable amount of time, you may find that borrowing money has strengthened the relationship rather than harming it.

Lending money should not be conditioned by a benefit

[Quran 5:2]

The instalments are a donation from the members, so it appears that requiring them to pay the donation first in exchange for a loan from the Project’s funds is not acceptable. This is akin to what the scholars, may Allah have mercy on them, said: when the creditor requires the debtor to give him charity, this is not permitted.

To summarise, lending money is a help contract; so, it is not authorised to condition a benefit, whether for the creditor or the debtor.

What should you do if you Have difficulty saying ‘no’ when asked to lend money

If you are unsure about this person’s honesty or ability to fulfil his debts, you have the right to withdraw your pledge. The bulk of scholars, may Allah have pity on them, believe that honouring a commitment is something desired rather than compulsory.

Furthermore, as you said in your question, this person has previously borrowed money from you and others and has failed to fulfil his bills. It’s also possible that you’ll never see him again and so won’t be able to get your money back. Anyway, you are not sinful if you break your promise, Allaah willing.

Furthermore, a Muslim enjoys priority over a non-Muslim when it comes to help and assistance. However, it is permitted in principle to lend money to a non-Muslim unless you know he would use the money in prohibited ways, in which case lending money to a Muslim is prohibited.

Allah is the most knowledgeable.